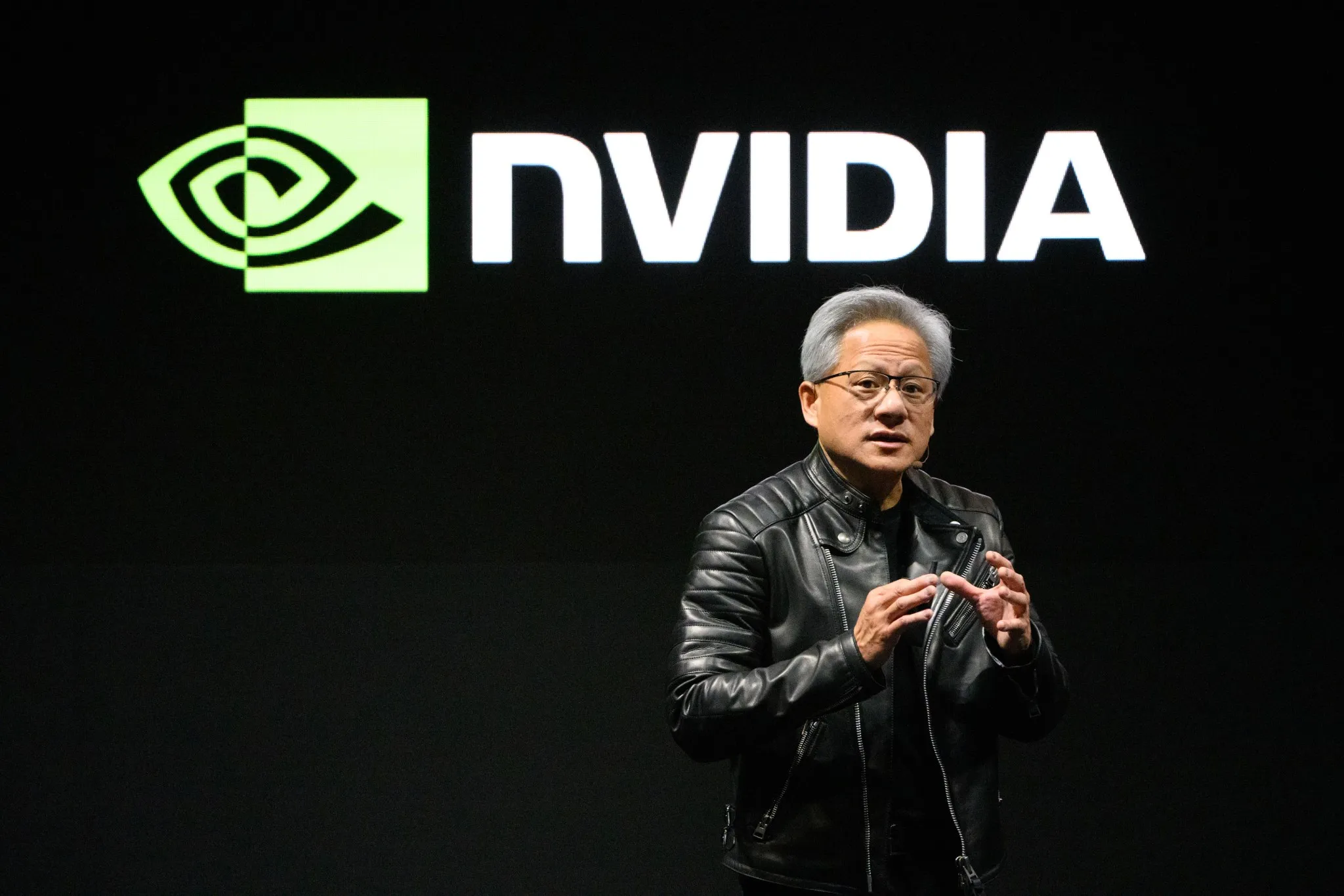

Jensen Huang vs. DeepSeek: Was Everyone Wrong?

Nvidia CEO Jensen Huang has addressed recent market concerns following the release of DeepSeek’s open-source AI model, R1. The announcement led to a significant sell-off, with Nvidia’s stock price dropping 16.9% in a single day, erasing approximately $600 billion from the company’s market capitalization.

In a pre-recorded interview, Huang expressed that the market’s reaction was based on a misconception. He emphasized that DeepSeek’s advancements are “incredibly exciting” and that their reasoning feature, which performs multiple thought computations for higher-quality responses, is compute-intensive. This, according to Huang, will actually increase the demand for AI computing power, benefiting companies like Nvidia.

Huang also highlighted that future AI techniques for inference will require more computing power, countering the narrative that more efficient AI models would reduce the need for advanced hardware. He reassured investors that Nvidia remains well-positioned to meet the growing demands of the AI industry.

Despite the initial stock decline, major tech companies such as Microsoft, Alphabet, Meta Platforms, and Amazon have increased their capital expenditure forecasts, indicating sustained investment in AI infrastructure. This trend suggests a continued reliance on high-performance computing solutions provided by firms like Nvidia.

In summary, Huang believes that DeepSeek’s innovations will serve as a catalyst for accelerated AI adoption, ultimately driving greater demand for Nvidia’s computing solutions.